Why Omnichannel is essential for betting and gambling in Africa and how Retailers can profit from Mobile diffusion?

.

In growing markets such as the African demographic, the government has steadily invested in undersea fiber-optic cables and infrastructures, and data related to the mobile and smartphones users (particularly in Nigeria, Egypt and East Africa – Kenya and Tanzania) are overwhelmingly positive. These promising signs highlight the growing potential of mobile and online gaming.

.

.

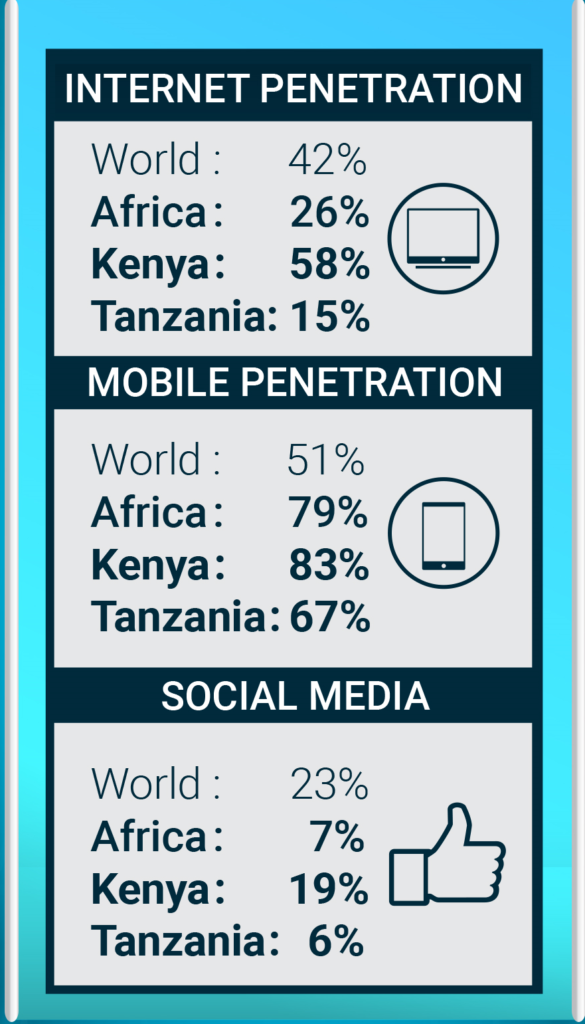

A prospect that highlights the potential of Internet and Mobile African users.

Viewed in comparison to global internet penetration numbers, the percentage in Africa can appear low. It is important to note that this data remains relevant nonetheless, particularly when taking into consideration the rapid increase in penetration in recent years

- Nearly 10% of the world’s internet users are in Africa

- A greater concentration is focused in urban areas where connectivity is superior and young population is more concentrated

In 2014 Eastern Africa accounted for around 31 million internet users, while in 2015 the number of internet users rose to an approximate 50 million and a projection for 2018 predicts more than 70 million of internet users.

The trends show how fast the number of internet users in Africa are increasing in the last years and at the same time show how internet and especially mobile users can become a growing potential market for the online gaming and betting operators.

.

Table: Internet , Mobile and Social Media penetration, the high potential of Africa

.

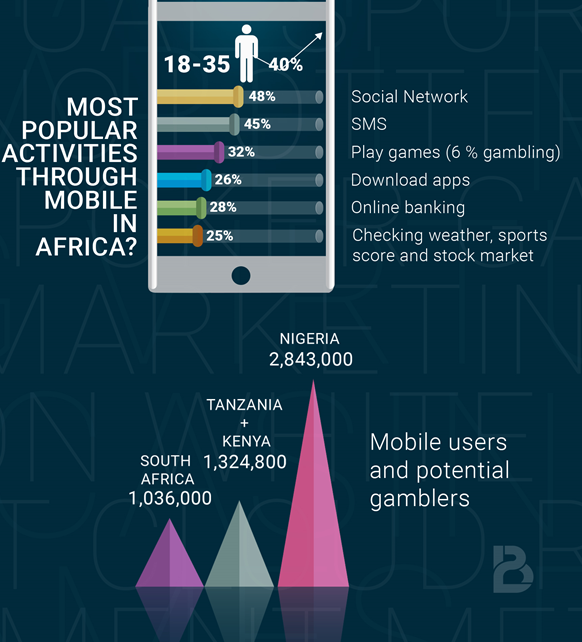

Mobile gamblers in numbers: an extremely attractive target for Retailers.

Africa seems to have mostly “skipped” the desktop generation, with the majority of users accessing the internet solely on mobile devices. Mobile users and players are principally male, aged between 18 and 35 years, interested in online betting and technology. For instance, in Kenya it is estimated that 36 million are mobile users (70% of the population) while Tanzania counts about 33 million (56% of the population), meaning that just two East African countries total 70 million target users. This is a projection of just two areas. If we spread the view on other countries, the potential become really wide.

Studies say that by 2018 mobile betting market in Nigeria, South Africa and Kenya will reach 37$ billion and analyzing the most popular activities that mobile users likes, the proportion is distributed as follows:

.

Statistics reported also the exploding numbers concerning the potential gamblers in Tanzania, Kenya, Nigeria and South Africa as from the table above.

In this perspective, the combination of the spread of mobile, improved internet connections and the growing number of users and gamblers makes the betting market extremely attractive to and viable for Retailers.

.

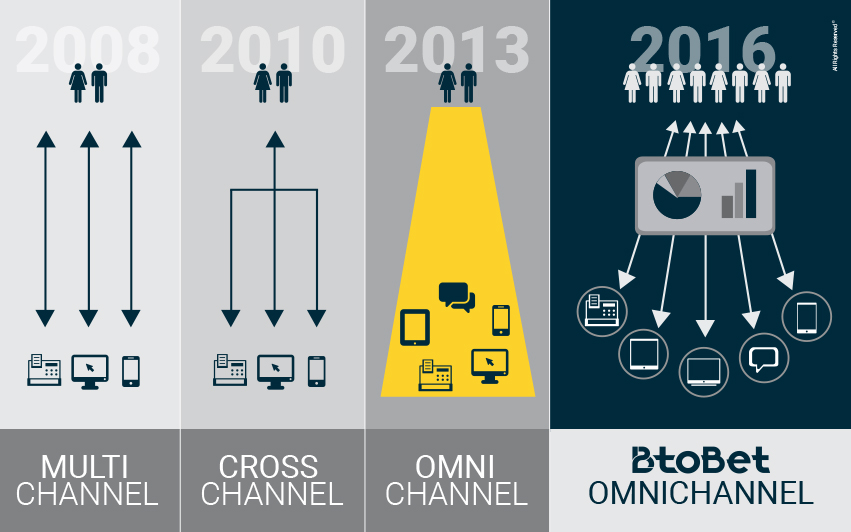

What do African Retailers require to move to Online and Mobile?

They will soon need a suitable platform and fitting software technology to manage player data and gambling-related business.

Commenting on BtoBet’s participation in Sport Betting East Africa from the 23rd-25th May in Nairobi – Kenya, Btobet’s CMO Sabrina Soldá highlighted:

“BtoBet is ready to give the African retail operators its next- level omnichannel platform, suitable for the needs of the gambling African market. Most multi-channel retailers have supply chain structures that are based around independently managed channels, the need to deliver a seamless and integrated customer experience across all shopping channels calls for an omnichannel platform embracing people, process, technology, and external partners. With BtoBet’s B Neuron AI platform, this process can be easily integrated and we are going to present all its features at the emerging markets in Africa and worldwide”.

.

Pingback: Great success for BtoBet at Ice Totally Gaming 2017 | Casino Gamers

Pingback: Great success for Btobet at Ice Totally Gaming 2017 – Beyond the A.I., exploring new frontiers of technology and marketing. – BtoBet