The Rise of Online Betting in Spain

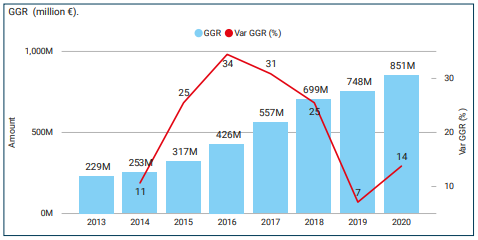

Online betting in Spain has been growing exponentially over the past six years. This is due to the widespread availability of the smartphone and internet technology which has had a direct impact on its growth. During the past years in Europe the betting and gambling sector has been showing strong growth, and Spain was a prime example of this growth trend, with the local iGaming industry growing by 268% since 2015.

We must also highlight the important fact that during these six years, the Spanish economy was not following the same growth trend, but its growth was surely aided by the rise of online betting in Spain. To properly display how the betting vertical experienced such significant growth in Spain, we must dissect the technological structure, market growth and dive into some of the player’s personal preferences.

Technological Infrastructure

Spain is a country with a population of 46.75 million people. The number of mobile subscriptions stands at 54.34 million, indicating a mobile penetration rate of 116.2%. Which is comparable to the 118% penetration rate of Western European countries. Internet penetration rate sits at a high 91% which again is quite comparable to Western Europe’s rate of 93%.

Compared to the previous year the mobile phone connections grew by 0.6% (+323,000 connections) whereas the number of internet users has been increased by 0.3% (+144,000 users) during the same period.

As expected is device preference is dominated by smartphone devices as 93.6% of all internet users choose it as their preferred device to access the internet.

The average daily time Spanish users spend using the internet is 2 hours and 48 minutes.

Market Growth

During 2020, the online market generated €850.7 million in GGR, which represents a 13.7% increase compared to 2019. This portrays a good picture of the growth potential the market has, and to further strengthen this potential, we must keep in mind the disruptive impact the Covid-19 pandemic has had on the industry.

For additional in-depth insights and statistics download our “Spain Betting Focus” industry report

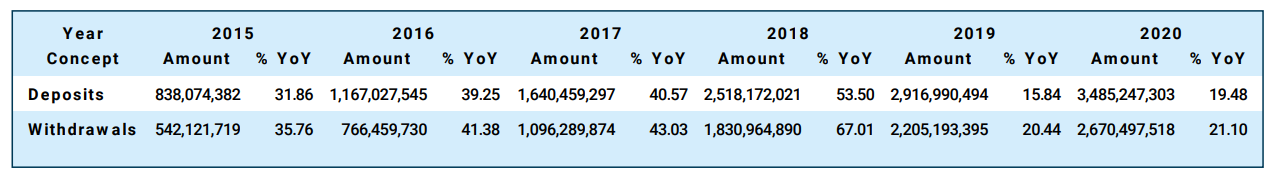

This growth was registered as well on player deposits and withdrawals, which were increased by 19.48% and 21.1% respectively. Alongside this, the number of active players also increased by 8.36% compared to 2019.

In terms of GGR generated by different verticals, sports betting has maintained the largest market share during 2020, with €365.14 million in GGR or 42.92% of the entire industry GGR.

Speaking of verticals, the casino has managed to generate €350.8 million in GGR during 2020, with the vertical representing a 41.23% of Spain’s iGaming industry.

On a more interesting note, from 2015 to 2020 the player deposits have more than quadrupled. During 2015 player deposits reached €838 million, whereas that number has skyrocketed to a record €3.485 billion in 2020.

It was during 2018 that this upward growth trend of deposits reached its highest peak with €2.518 billion or a 53.5% increase compared to 2017 when the deposits reached €1.640 billion.

Player Preferences

According to in-depth data provided by the Directorate-General for the Regulation of Gambling (DGOJ) – Spain’s national regulatory body – during 2020 the Spanish players preferred betting on live sports which resulted in a total turnover of €4.1 billion, which is 58.47% of the total sports betting vertical turnover. To properly showcase the growth of live sports betting it is vital to bring out one very interesting fact from 2014 where pre-match betting amounted to almost 99% of the total turnover or €2.85 billion from a total turnover of €2.89 billion. Whereas in 2020, pre-match betting accounted for 36.27% of the total sports betting vertical turnover.

It is worth mentioning the strong growth horse betting registered in 2020 with €201 million, which is almost double the amount this vertical has generated during 2019 – €104 million.

Overview

The Spanish betting and gaming industry has experienced significant growth over the last 5 years with last year’s disruptive landscape highlighting the market’s resilience. Nonetheless, there is a sense of expectancy for the effects that the new restrictions on advertising will have on the sports betting industry, and whether these restrictions could aid the casino vertical to close the gap to the betting vertical and possibly overtake it in terms of market share.

For the complete market overview download our “Spain Betting Focus” industry report