Sailing the uncharted waters of Cyber Sports in CIS – Eastern Europe

Rising opportunities in Eastern Europe

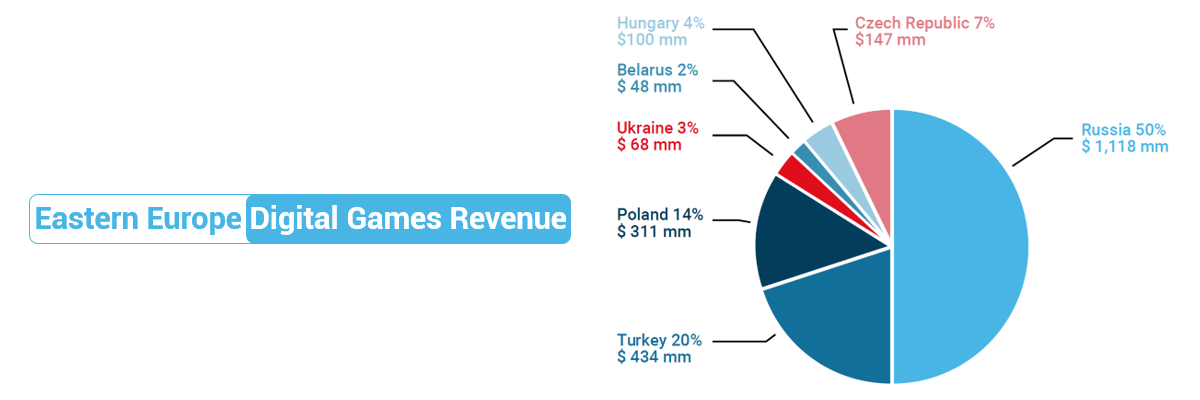

A rough estimate says that there are around 3.3 million online gamers in Eastern Europe alone. The revenue of these online gamers is $2.2 billion in this designated area, and it grows by 7% year over year. Russia, alone, takes half of the digital games market with $1.12 billion, followed by Turkey and Poland, together these three make up to 84% of the Eastern European market.

In the majority of Eastern European countries, online casino and sports betting are not regulated or even face heavy restrictions. This has been one of the reasons that have led to flourishment of the online gaming and eSports competitions. This is a factor that should be taken into consideration by operators when exploring the potentials of these markets.

This is particularly the case in Russia, where land-based casinos have been forced to operate in special gambling zones, and online gambling is not regulated, with the hope it will be in time. In countries such as these, due to the lack of online gambling, the popularity of video, social games and mobile games has been on the rise.

International sports-betting companies have faced threats and difficulties in Russia by the authorities, but in the end, the laws on online sports-betting have not been powerful enough to stop Russian gamblers in the huge market from betting. In Russia at this time casinos, gaming machines, betting, racing and lottery games are the only ones regulated. Remote gambling remains prohibited, however, a centralised online sports-betting system is in operation following amendments to the law in the past few years. There is a state-controlled lottery set up, and the gaming machines are restricted to five designated gambling zones.

Why focus on the Russian video gaming market and eSports

We can’t overlook the shift of Russia towards cybersports and eSports over traditional sports betting and casino, that is why operators must diversify the offer in this region in order to profit from the given opportunity and satisfy the need for it. This trend besides showing great potential offers hints as to how to develop strategies and offers in order to succeed in these territories.

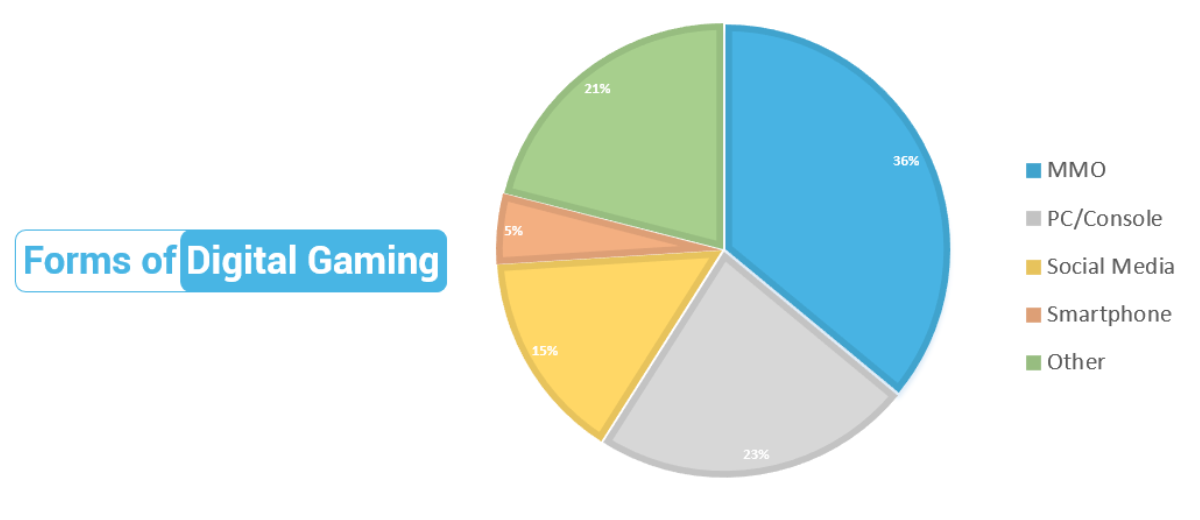

There are four main factors that must not be overlooked when it comes to the growth of digital gaming in the region. Massively multiplayer online games are the largest form of digital gaming with up to 36% of the market closely followed by PC and console games which account for 23% of the total games’ revenue. The growing popularity of credit-card payments in Eastern Europe has been of great help since it makes it easier for gamers to legitimately download digital content. Social media is a growing segment with 16% of the total digital games market by revenue, and the smallest segment is the smartphone with only 5% because of the limited smartphone penetration in this area of Europe, where 86% of devices are Android leading to far higher game installs on these devices.

The 65% of Russia’s online population of 110 million people plays video games, making gaming one of the largest leisure sectors in Russia. Of the 72 million gamers in Russia, 56% of them actually pay for games and those 40.4 million spent on average in 2017 $40, including both games and in-app purchases as well as expenditures for those games. This makes Russia the 11th largest gaming market in the world making it a key focus for any online gaming company expected to grow even further making it a very important market.

The technology required to conquer the betting market of Eastern Europe.

A.I. is crucial to this process of providing personalised and satisfying offers cross-channels to your players. This is a continuous process – a flow of information, analysis and suggested bets that can be offered to each player regardless of channel – and which can help operators direct traffic between mobile, online and retail. Through the A.I. and the related concept of the Recommendation Engine, operators can now automatically group users into clusters providing each cluster with cross-channel marketing solutions.

The fast growing phenomena of eSports, being completely different from the traditional betting market is important to understand properly. Operators must be prepared for It in order not to lose ground against the competition. It is important to understand the audiences’ preferences in order to attract and retain the millennial customers which are the vast majority of this target group. Here too, same as traditional betting, age and preferences need to be considered in order to provide an offer in line with the players’ expectations.

To attract this new market, operators must understand the nature of the potential customers. Almost in no case, they are simply bettors, but the overwhelming majority of eSports enthusiasts, are both participants and spectators alike, belong to the generation which is always connected and ahead of the game in terms of technological advancements. Operators need to warm up to them working on their brand reputation, communicating strongly on social networks, boosting their brand presence and write good content that will be to their liking creating positive value association with their brand.

Implementing an eSports element to your pallet is extremely important, which is why BtoBet offers an eSports solution that will enable you easy communication with eSports fans. You will be able to provide a tailored offer that will evoke trust and loyalty from your new customers in the competitive race of eSports. Betradar’s solutions in combination with BtoBet’s AI software are a perfect set for the eSports market providing benefits for bookmakers and eSports fans and cyber-bettors in Russia and in the rest of Eastern Europe.

Find out more on the subject in our White Paper! Download our whitepaper on CIS-Eastern Europe Gaming or cybersport betting? Opportunities and strategies